There are several parallels between trading and chess:

Both require strategy: In trading, traders must devise a profitable strategy for buying and selling stocks or other assets.

Chess players must devise a strategy in order to capture their opponent’s pieces and eventually win the game.

Both involve risk management: In trading, traders must manage their risk by carefully evaluating each trade’s potential risks and rewards.

In chess, players must consider the risks of each move and plan accordingly to reduce the risk of losing their pieces.

Both require analysis and decision-making: Trading and chess both necessitate the ability to analyze situations and make decisions based on the information at hand.

To make informed trades, traders must analyze market conditions, company financials, and other factors.

To make strategic decisions in chess, players must analyze the board and their opponent’s moves.

Both require discipline and patience: To be successful, both trading and chess require discipline and patience.

Traders must be disciplined in order to stick to their trading plan and avoid making rash decisions.

Similarly, before making a move in chess, players must be patient and wait for the right opportunities to present themselves.

Trading and chess both require strategy, risk management, analysis, and decision-making, as well as discipline and patience.

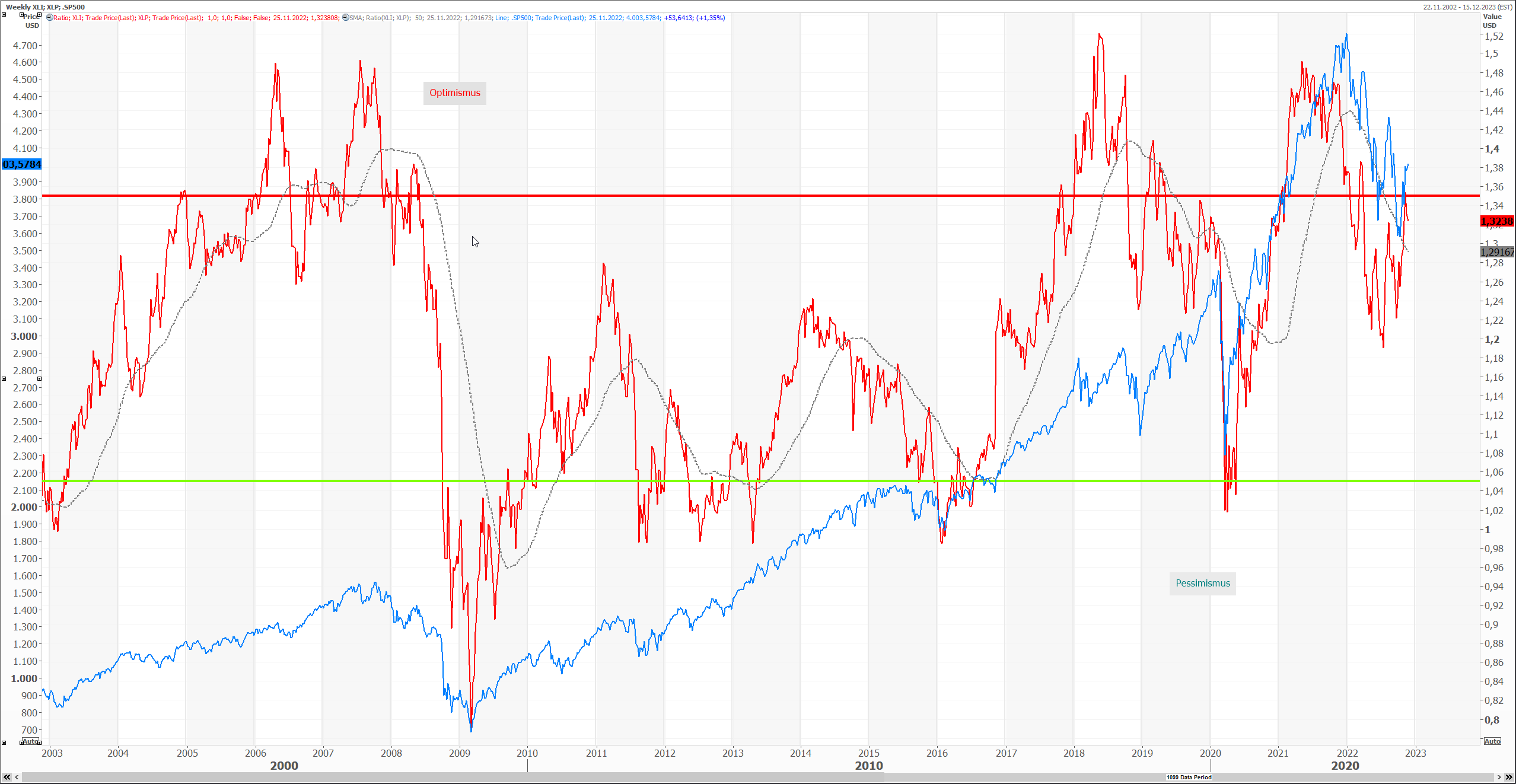

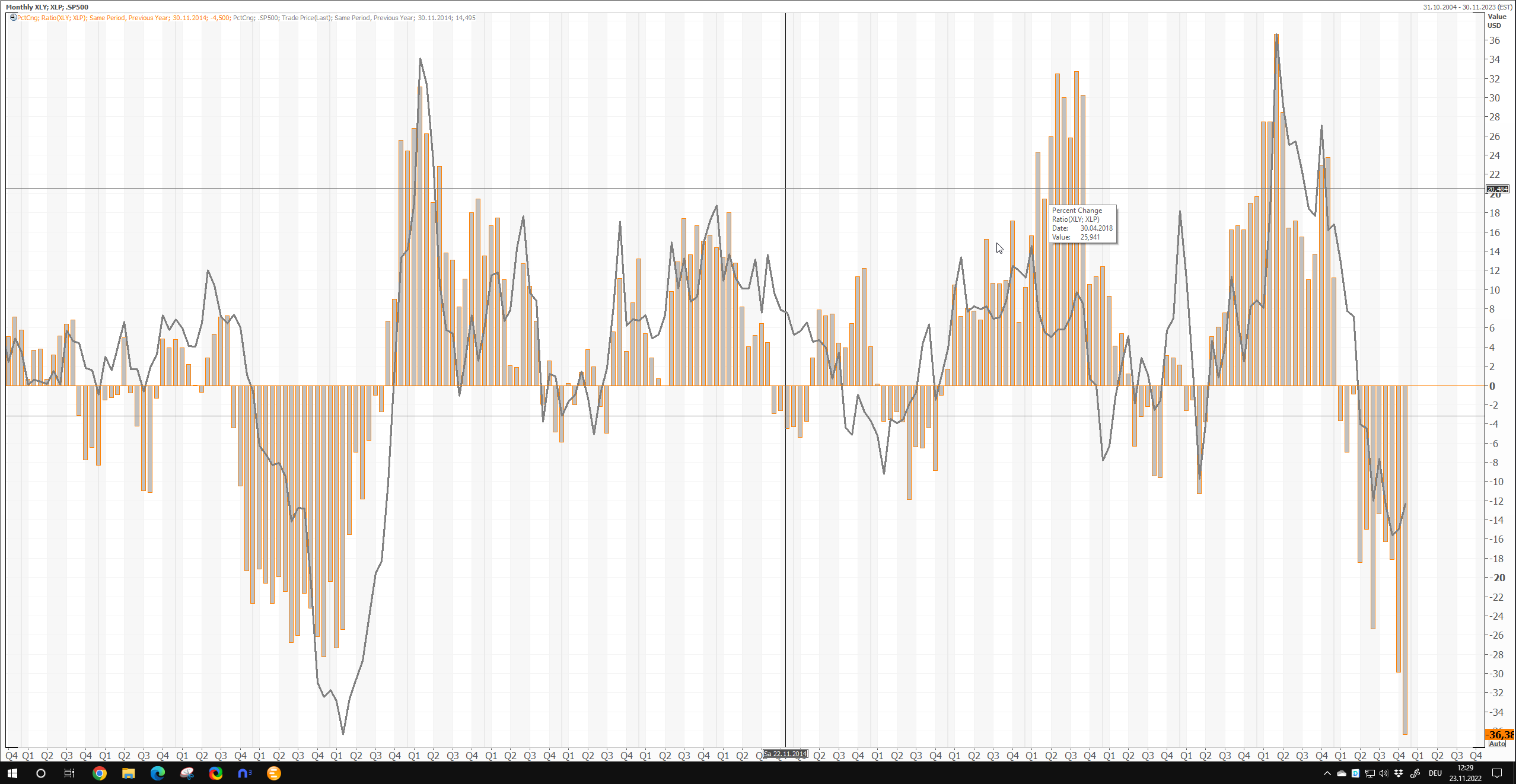

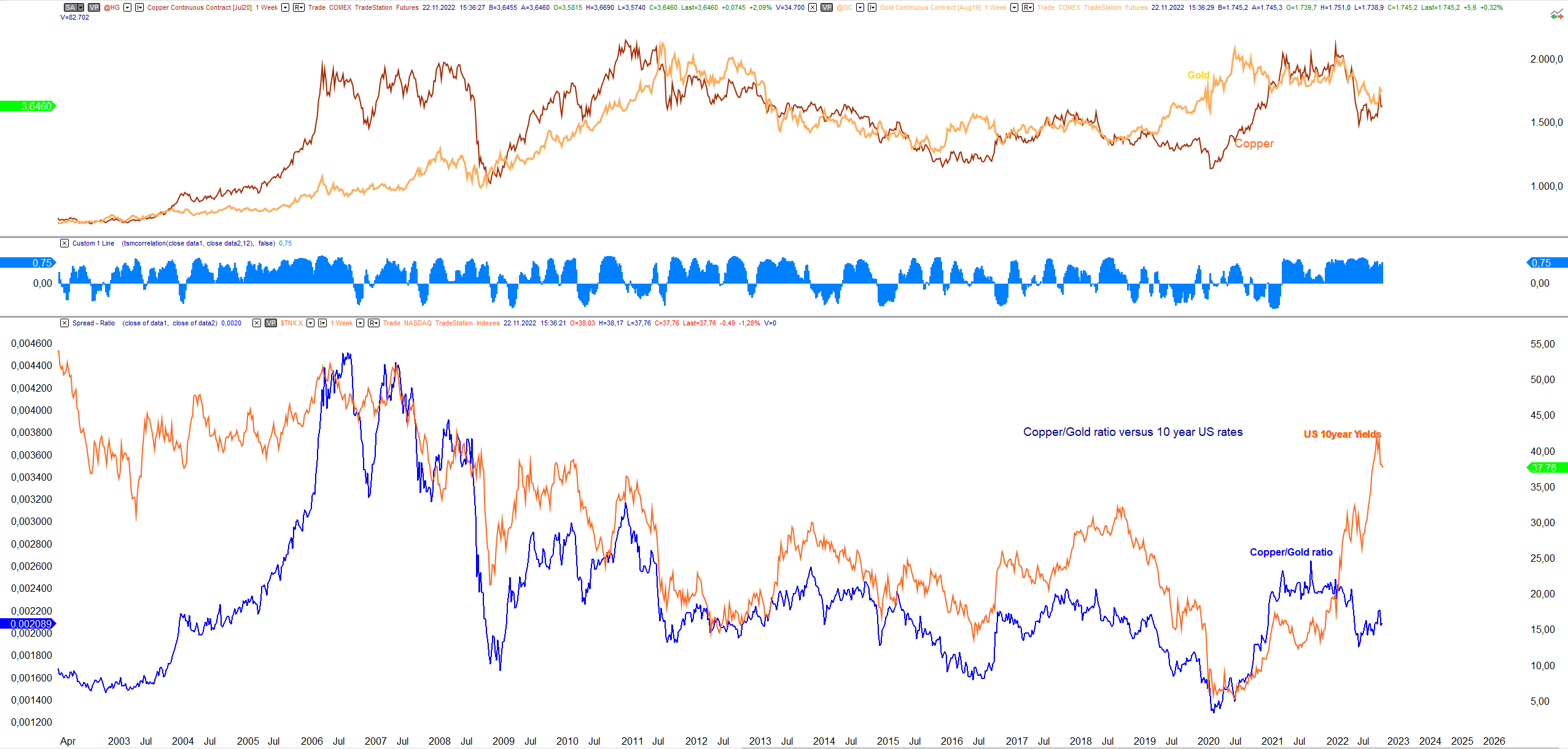

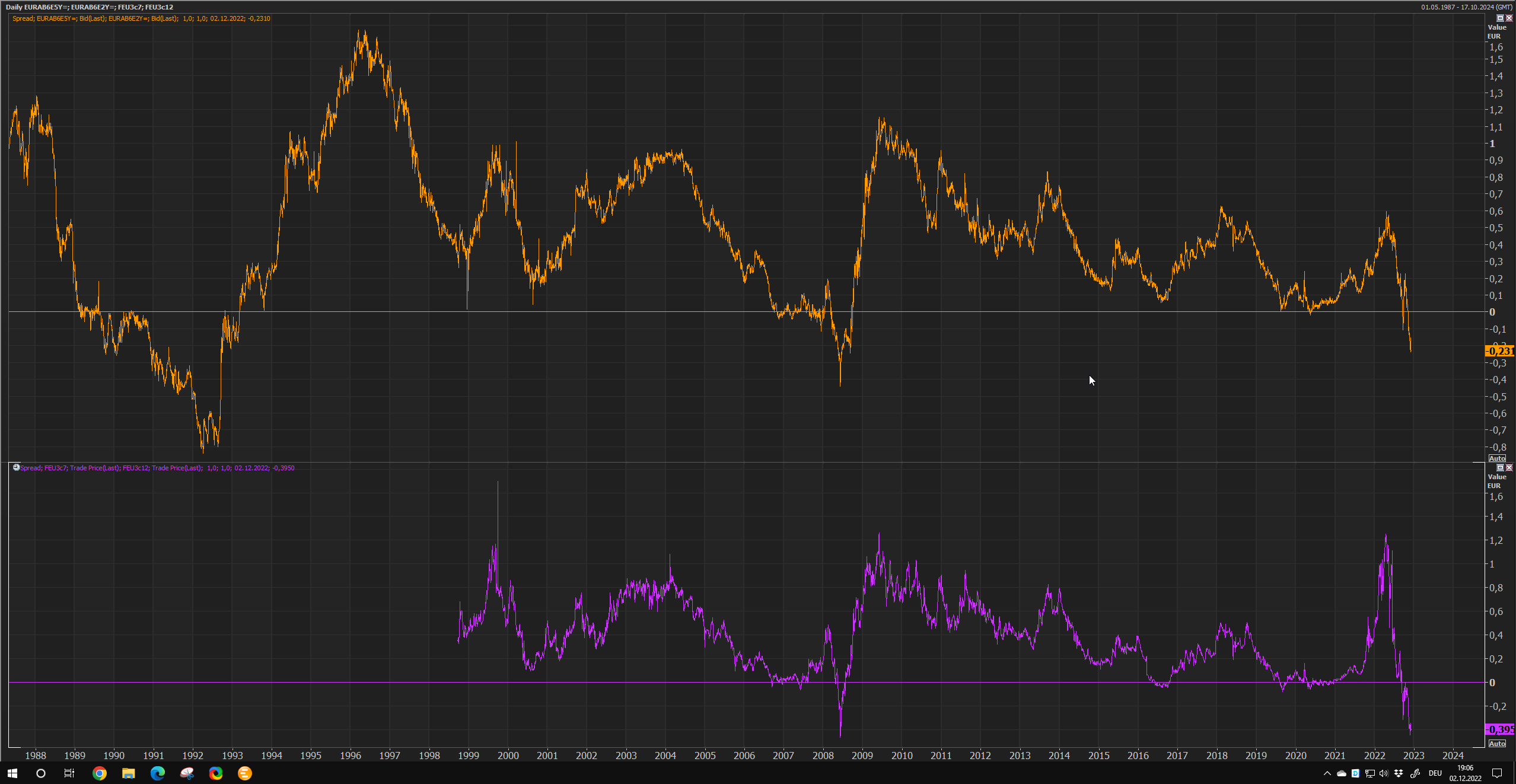

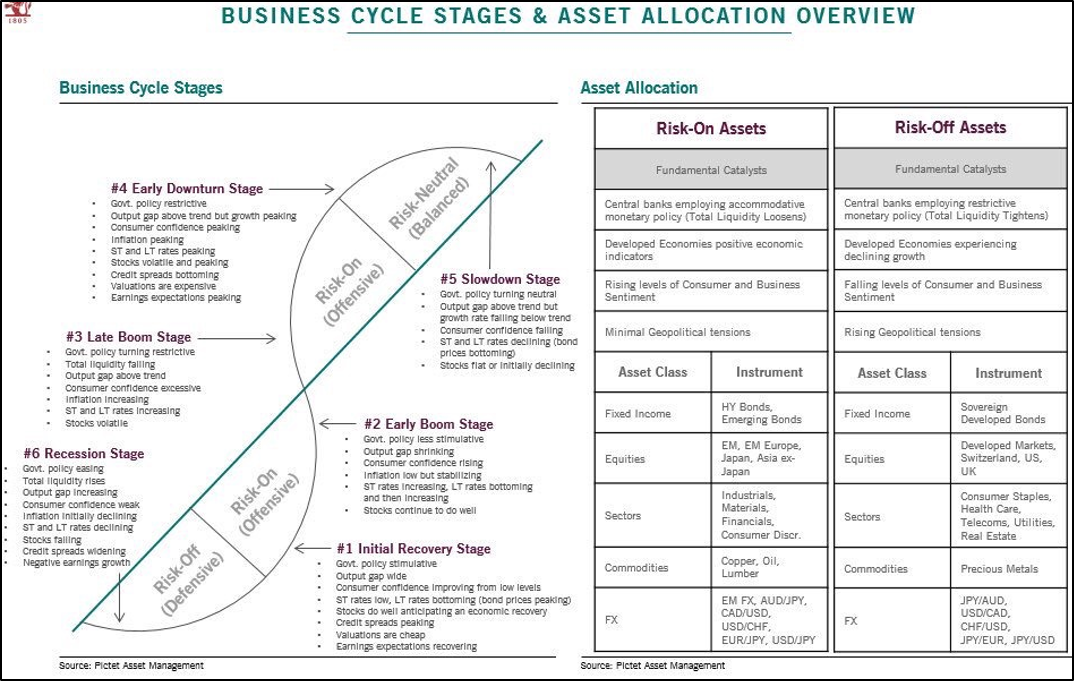

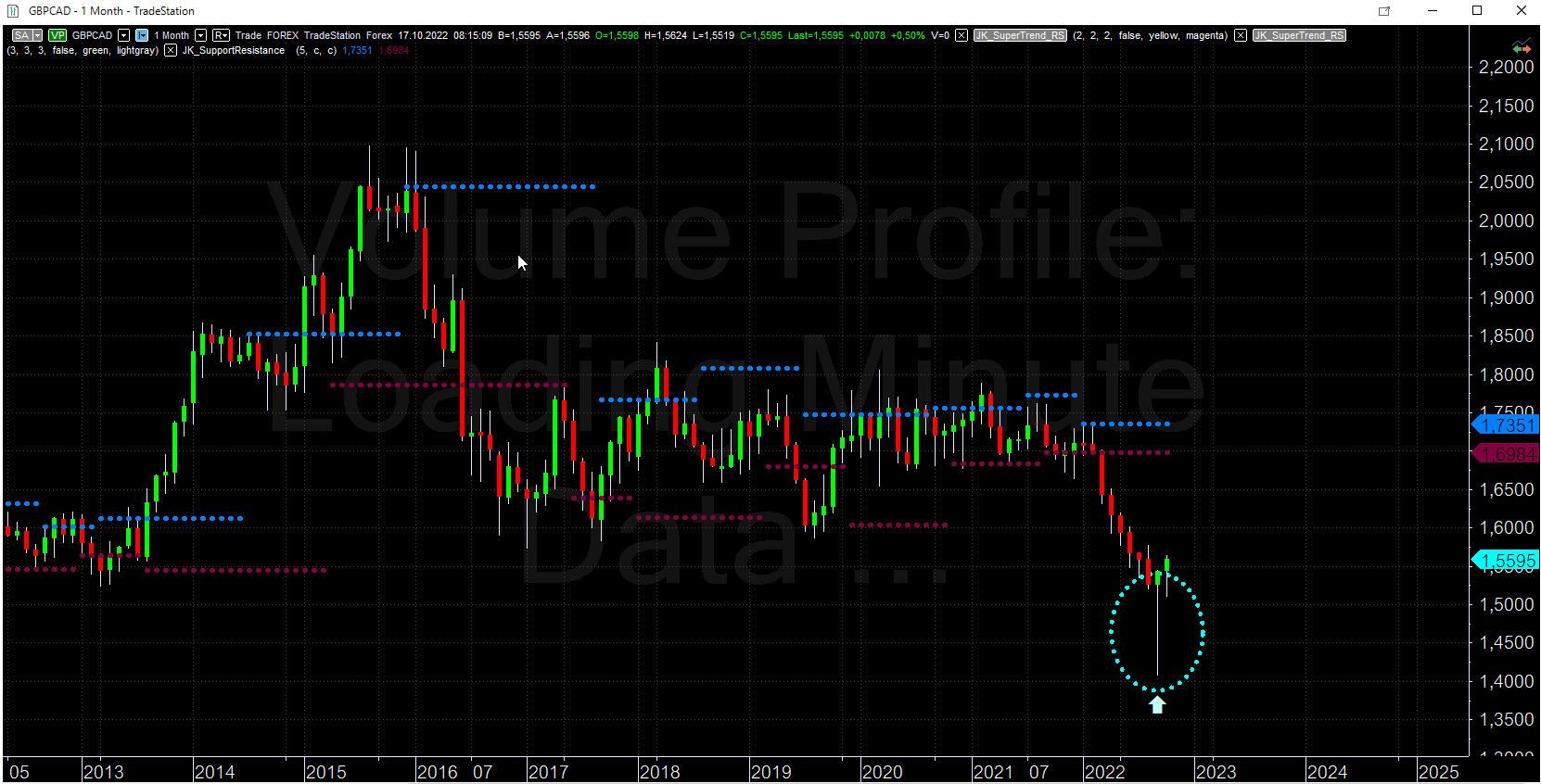

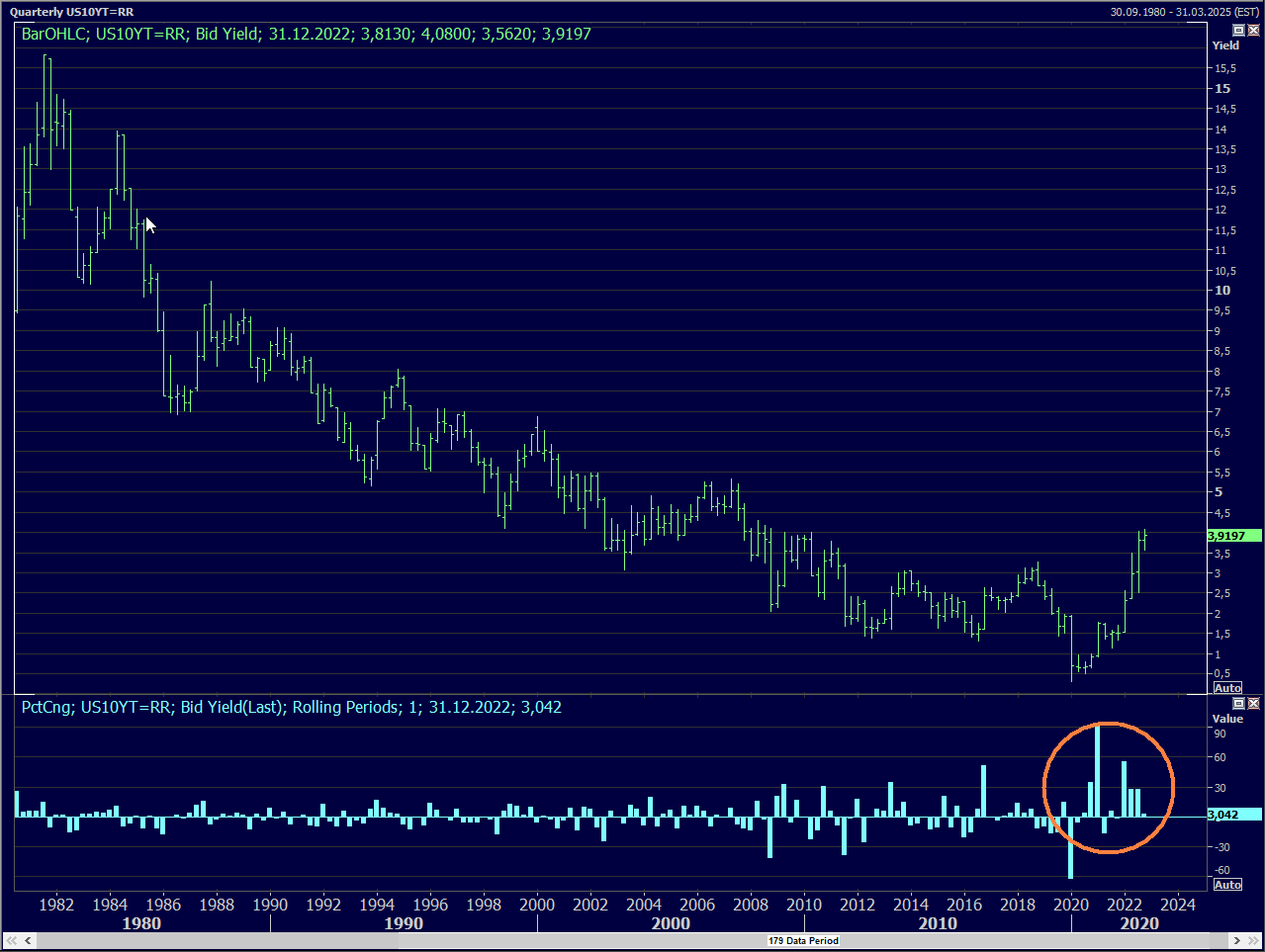

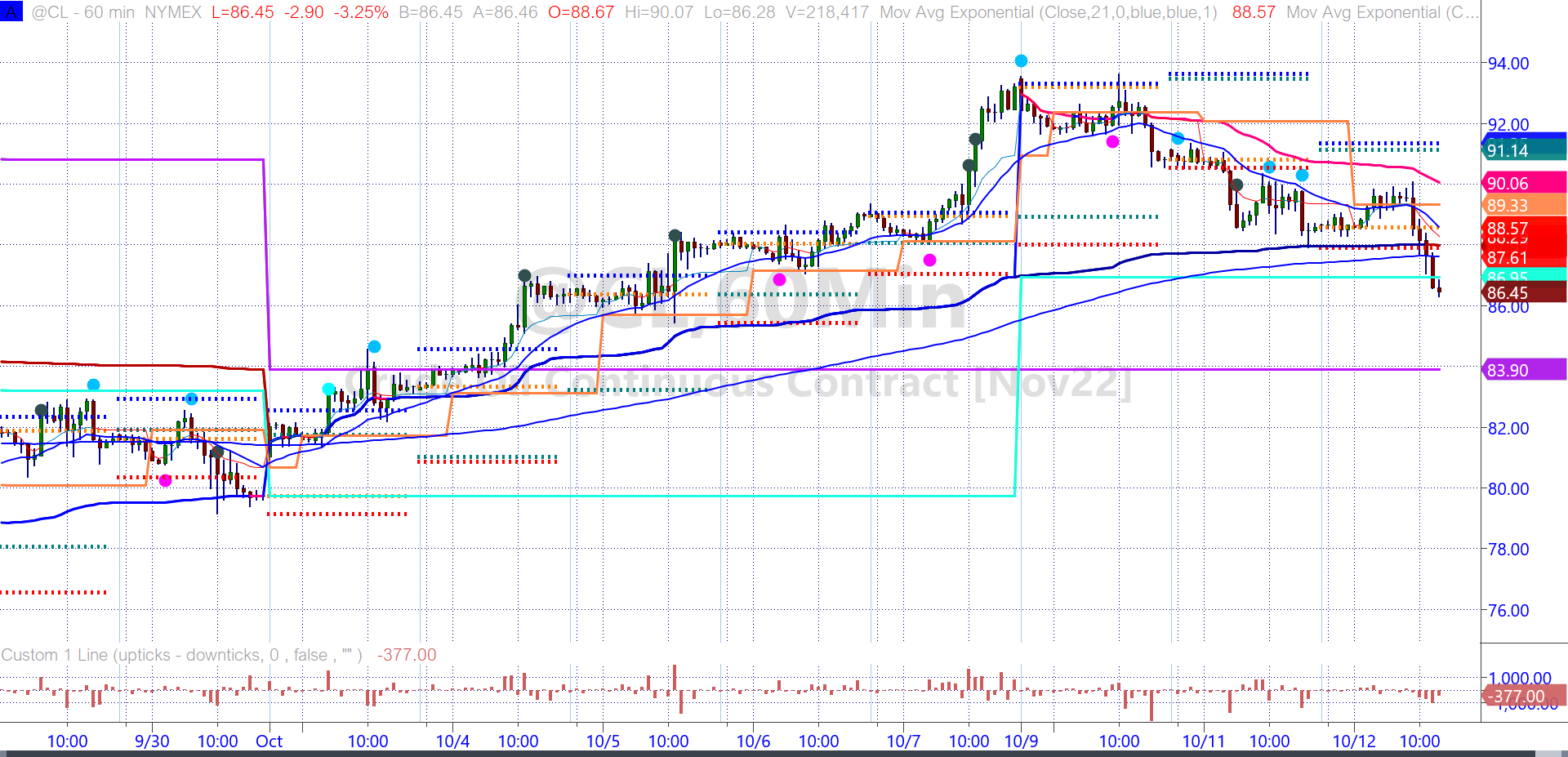

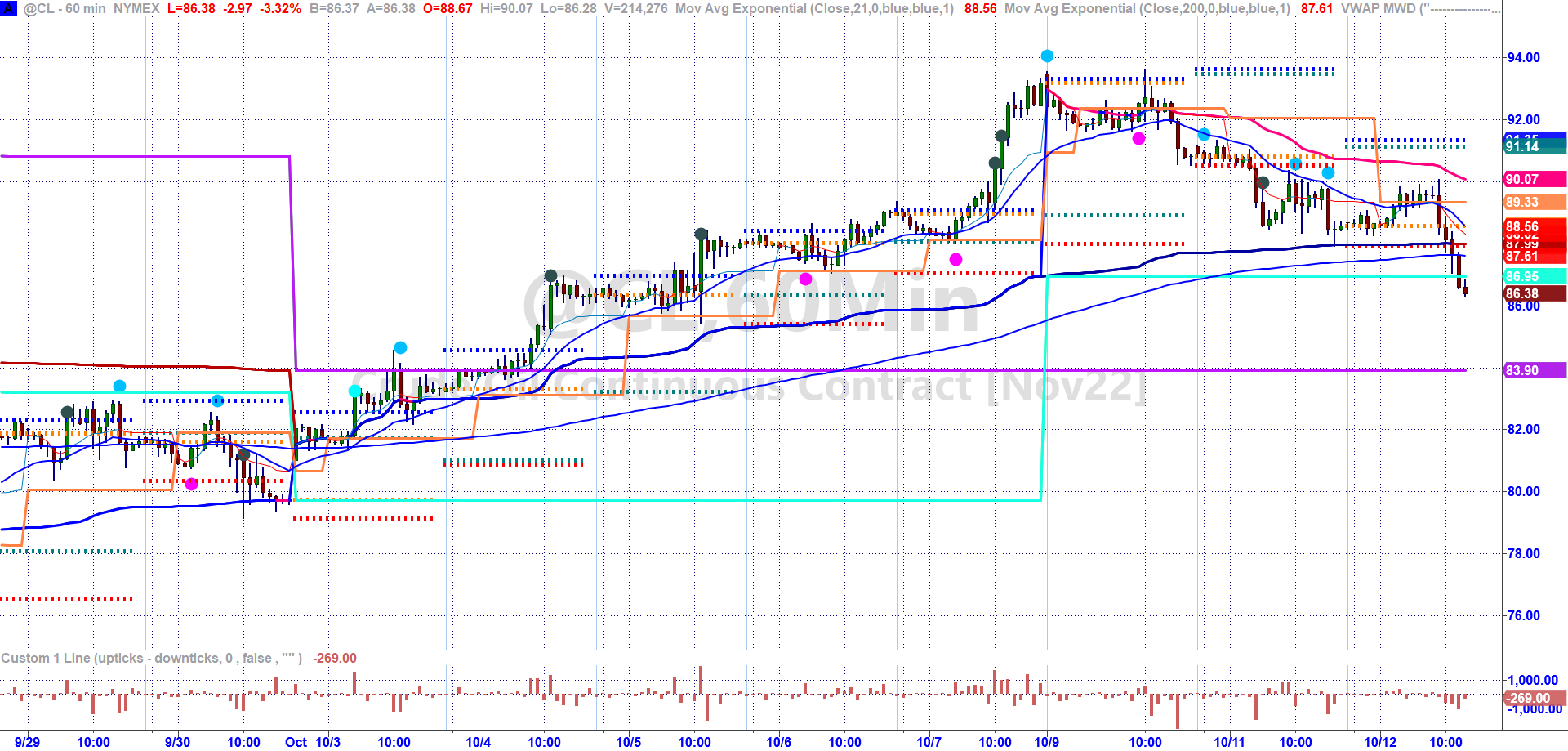

A small selection of my analysis work.